Real Rate Increases Must Outpace Nominal Rate Increases To Achieve Deflation

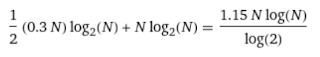

They say that higher interest rates reduce the demand for money. It is probably more precise to say that higher rates reduce the demand for debt. Borrowers tend to be spenders, after all, that is why they borrow. However, there is at least one way that higher rates actually increase the demand for debt: existing borrowers must cover their outstanding debts or default. At least one of these borrowers is the country itself. Unless the treasury can reinforce the contraction of debt based money, by shrinking the national debt, it is hard to imagine that high interest rates can fight inflation on their own. But there is a much simpler and direct way that a nominal rate hike may add difficulty to the task of inflation reduction. For a nominal hike to be deflationary, the real rate increase must outpace the nominal rate increase. To demonstrate this, let's look at the fisher equation again. I like to first recall the fisher equation as the definition of the real r...